索拉纳(SAL)p赖斯预测:f的看涨与看跌情况SAL的实际价值

Solana(SAL)加密货币一直是加密货币领域最受关注的资产之一,以其高性能区块链和近年来市值飙升而闻名。

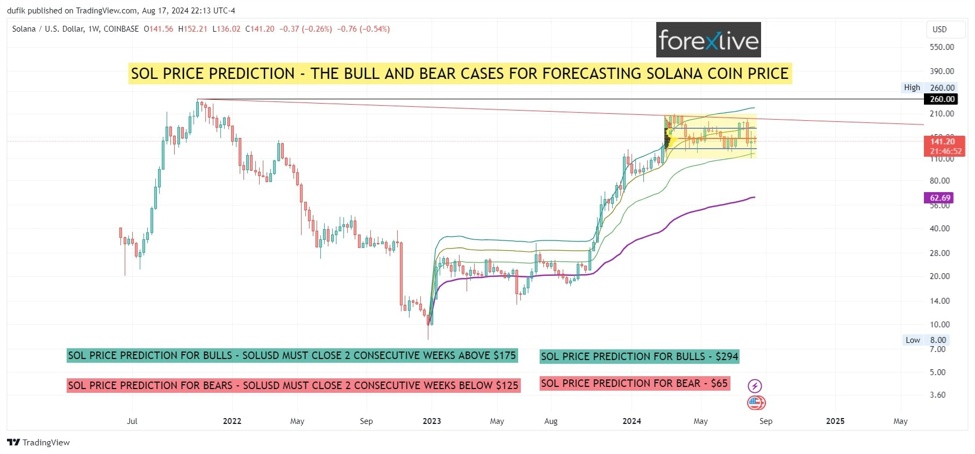

As someone who has actively traded Solana since its early days, I’ve observed firsthand how quickly market sentiment can shift in the crypto space. I recall the dramatic rise of SOL in 2021, when 一年内从1美元以下飙升至200美元以上, driven by widespread adoption of its high-performance blockchain for decentralized applications. Even this year, when SOL crossed up a 66 day long high of a key price level of apx $127, it then flw up another %67 in only 17 days. 这次经验告诉我,了解关键阻力位和支撑位(例如本分析中概述的那些)对于应对加密货币市场固有的波动至关重要.

当前价格分析有两面

截至图表上的最新数据,Solana(SAL)的交易价格约为141美元大关。图表突出显示了一段盘整时期,SAL一直在相对狭窄的范围内交易,表明市场正处于关键时刻。价格在175美元附近找到阻力,在125美元附近找到支撑。

看涨情景:通往历史新高的道路.🚀但等待这个条件.

For the bulls to take control and push SOL’s price higher, the chart indicates a key resistance level at $175. According to the analysis, a持续突破175美元,建议连续两个周线收盘在该水平上方即可确认. This could trigger a bullish breakout, leading to a potential surge in price.

- 公牛队的关键水平:175美元

意义: Closing above this level for two consecutive weeks could lead to a major bullish trend.

下一目标: $294 💰

If SOL reaches $294, it would represent a potential upside of more than 100% from the current price, making it an attractive target for long-term investors and traders. The $294 target is likely based on previous highs and Fibonacci extensions, suggesting that once the $175 resistance is broken, momentum could carry the price to new highs.

Solana Labs联合创始人Anatoly Yakovenko最近在X上发表的一篇文章中指出,对于许多用户来说,使用以太坊网络的相关费用高于运营Solana节点的成本。这种比较凸显了领先区块链平台之间关于网络效率和成本效益的日益激烈的争论,这有助于看涨的情况。

But, in any case, in terms of price action for SOLUSD, to further understand 175美元阻力位的重要性, it’s important to delve into the use of anchored VWAP bands which offers a nuanced perspective by combining volume and price over a specific period, helping traders pinpoint areas where institutional players might have entered or exited positions. I show a thorough yet simple technical analysis of this in my following video

SAL价格预测视频

熊市情景:下行风险和支撑水平️

另一方面,如果索拉纳未能维持当前的支撑水平,熊市就会开始发挥作用。图表将125美元确定为关键支撑位。对于空头来说,一个重要的信号是连续两个周线收盘于125美元以下,这可能表明下跌趋势的开始。

- 熊的关键水平:125美元

意义: Closing below this level for two consecutive weeks could trigger a bearish trend.

下一步支持: $65 📉

In this bearish case, the chart points to $65 as the next major support level. This level is approximately 50% lower than the current price, indicating substantial downside risk if the bearish scenario materializes.

了解技术指标:标准差带预设

该图表基于从历史低点SAL/USD的锚定VWAP(体积加权平均价格),具有几条标准差带。这些不是传统的移动平均线,而是统计带,显示价格自历史低点以来与平均价格的偏差程度。

- 为什么使用锚定VWAP频段?

For Algorithms: Anchored VWAP and its deviation bands are commonly used by algorithms and quantitative traders to identify overbought or oversold conditions.

For Traders: These bands help traders determine potential reversal points or areas of strong support and resistance based on historical price action.

锚定VWAP及其标准差范围提供了更动态的市场视图,随着价格变动进行调整,以实时感知市场情绪。当SAL的价格接近或越过这些区间时,可能预示着潜在的买入或卖出机会。

结论:这是solana spel的关键时刻,但请记住这些水平以供指导

总而言之,索拉纳的价格目前处于中间区间,关键水平为175美元和125美元,是下一个重大举措的关键指标。

For Bulls: Look for two consecutive weekly candle closes above $175 to signal a potential surge towards $294. 📈

For Bears: Watch for two consecutive weekly candle closes below $125 as a potential signal for a drop to $65. 📉

Investors and traders should closely monitor these levels and be prepared for increased volatility as SOL approaches these critical junctures. The use of anchored VWAP and its standard deviation bands offers additional guidance, providing a robust framework for decision-making in a highly dynamic market.

这不是财务建议,只是我的专家意见。与往常一样,在做出任何投资决定之前,进行彻底的研究并考虑所有因素,包括更广泛的市场状况非常重要。请访问ForexLive.com了解更多观点 🧐