美元走低.

收益率较低 , 2 年期下降 – 28 个基点.10 年期收益率下降 – 18 个基点.

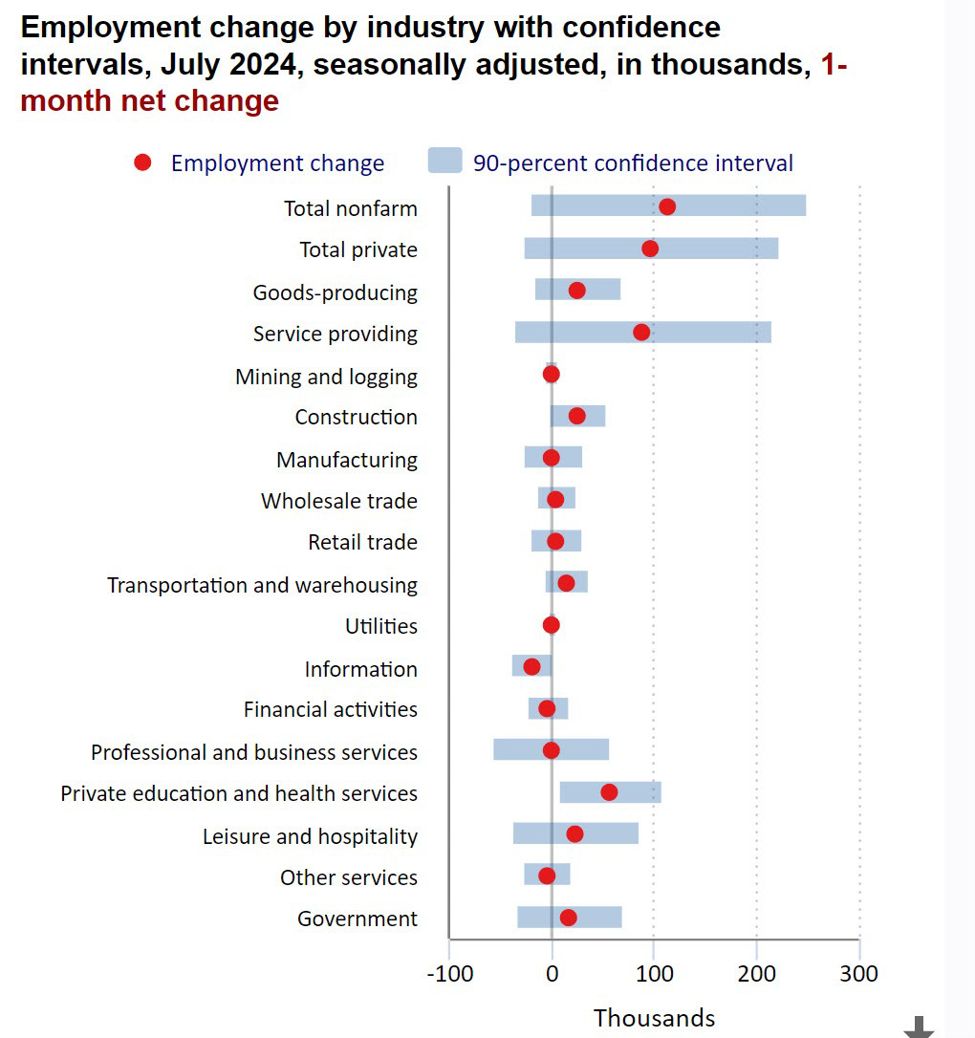

在美国就业报告疲软之后 , 股市正从已经低迷的水平走低.标准普尔指数下跌 – 101 点.道琼斯工业平均指数为 – 575 点.纳斯达克指数 – 476 点.

市场现在预计到年底削减 – 108 个基点.下降超过 – 20 个基点.现在 9 月份有 73% 的机会削减 50 个基点.

失业导致失业.美联储现在落后于曲线.债券市场正在为美联储做工作 , 因为为时已晚.

在外汇中 :

- EURUSD: The EURUSD moved sharply higher off the report, and tested a key swing area near 1.0872. IN the process, the cluster of MAs were broken with the price above the 100 and 200-day MA, and the 100/200 hour MAs. Looking at the chart, you can see the key level and that is where it stopped.

- USDJPY: The USDJPY is trading to the lowest level since March. The next target area comes in between 145.89 and 146.514. Going back to November to March that area was a swing level where it provided either support or resistance before basing against the level one last time in March near 146.51 before racing to the upside.