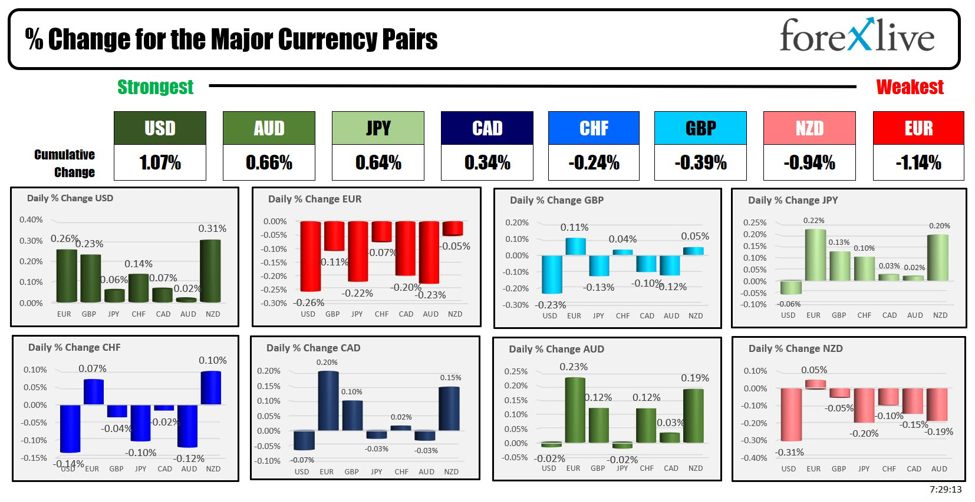

随着北美时段的开始 , 美元是最强的 , 欧元是最弱的.在繁忙的一周之前 , 股市从周五开始的复苏仍在继续.在周三 FOMC 利率决定之前 , 美国收益率走低 ( 预计不会发生变化 ).英国央行 (削减 60% 的机会) ,日本央行 (他们可能会加息并削减债券购买) 也将宣布他们的利率决定.

上周末 , 在纳什维尔的比特币 2024 上 , 共和党提名人特朗普承诺不出售任何联邦政府持有的比特币 , 旨在建立一个战略性的国家比特币储备.他批评政府过去出售没收的比特币的行为.此外 , 他承诺如果当选 , 将在上任的第一天解雇 SEC 主席 Gary Gensler , 这引起了热烈的掌声.有关更多详细信息 , 请单击此处.

本周 , FOMC 将于周三公布利率决议.预计美联储将维持利率不变 , 但可能会在 9 月份的下一次会议上为降息铺平道路.上周末 , 有关该决定的一些评论包括以下内容 :

- Morgan Stanley predicts that the upcoming FOMC statement will set the stage for three rate cuts this year, starting in September. They cite significant progress on inflation as a key factor. Although Federal Reserve Chair Powell is expected to express increased confidence in lowering rates, he will likely avoid specifying a precise timeline during his press conference following the FOMC meeting on July 30-31. For more details, you can read the full article here.

- UBS forecasts that the Federal Reserve will pivot its policy soon, anticipating a 25 basis point rate cut in September. They believe the US economy is heading toward a soft landing, with below-trend growth, rising unemployment, and broad disinflation in place. UBS sees no imminent risk of a hard economic landing. For more details click here.

英格兰银行将于周四宣布其利率决定.德意志银行预计英国央行即将召开的会议将做出密切决定 , 预计 5 票对 4 票赞成降息 25 个基点.他们预计这将启动该周期的首次降息 ,将银行利率降至 5%.该预测取决于货币政策委员会越来越依赖通胀预测以及工资和服务价格的前瞻性指标.有关更多详细信息 , 请单击此处.

收益也将成为本周的中心.麦当劳今天早上宣布了他们的收入.

麦当劳公司 ( MCD ) 2024 年第二季度 ( USO ) :

- Adj. EPS: $2.97 (expected $3.07) – Missed expectations

- Revenue: $6.49 billion (expected $6.61 billion) – Missed expectations

- Comp sales: -1% (expected 0.84%) – Missed expectations

在交易周 , 微软、 Meta 、亚马逊和苹果将重点关注收益 , 其他行业巨头也宣布.以下是一些主要公司宣布的时间表 :

星期一

- Before the open: McDonald’s, Phillips

- After close: Tilray

星期二

- Before the open: SoFi, Pfizer, PayPal, BP, P&G, Corning, Merck

- After close: AMD, Microsoft, Starbucks, Pinterest

星期三

- Before the open: Boeing, Kraft Heinz, Altria

- After close: Meta (Facebook), Qualcomm, Carvana, Lam Research, Western Digital

星期四

- Before the open: Moderna, ConocoPhillips, Wayfair, SiriusXM

- After close: Amazon, Apple, Intel, Coinbase, DraftKings

星期五

- Before the open: ExxonMobil, Chevron, Frontier Communications

似乎上述还不够 , 本周以美国就业报告结束 , 预计美国将增加 177K 个工作岗位 , 失业率保持在 4.1% , 预期收益为 0.3%.预览就业发布将是周三发布的 ADP 报告的序幕 ,周二的 JOLTS.

澳大利亚储备银行将于 8 月 5 日和 6 日举行会议.对于该决定而言 , 重要的是 2024 年第二季度和 2024 年 6 月的 CPI 通胀数据.两者都应在 11.悉尼时间 7 月 31 日星期三上午 30 点 ( 格林尼治标准时间 0130 和美国东部时间 2130 ).

澳大利亚联邦银行的片段预览点强调了数据对未来政策行动的重要性.:

- The Q1 24 CPI and recent monthly CPI indicator outcomes have been above expectations, and the RBA has sharpened language on the inflation outlook

- the prospect of a hike in August hinges on the RBA’s preferred measure of underlying inflation, the trimmed mean.

联邦商业银行认为该决定有 3 种情况.

- Their forecast for next week is for trimmed mean inflation to increase by 0.9%/qtr and 3.9%/yr. They see that number would give the RBA enough breathing room to leave rates on hold, despite it being marginally above their implied forecast of 0.8%/qtr.

- If CPI in at 1.0%/ it would be in the “grey zone” where they could hold or could hike depending on the component details.

- Finally, a print of 1.1%/qtr or above would test the Board’s resolve and shift the balance of probabilities to an interest rate increase.

欧盟 CPI (周三) 、 PMI 数据 (周四) 、初请失业金人数 (周四) 、瑞士 CPI (周五) 也将公布 , 重要.

北美会议开始时其他市场的快照显示 :

- Crude oil is trading down -$0.33 or -0.40% at $76.83. At this time Frida, the price was at $77.91.

- Gold is trading near unchanged at $2387.90. At this time Friday, the price was trading at $2373.

- Silver is trading up $0.10 or 0.35% at $28.01. At this time Friday, the price is trading at $27.73.

- Bitcoin trading higher at $69,435 after the bitcoin conference in Nashville. At this time Friday, the price was trading at $67,298

- Ethereum is trading higher as well as $3373.30. At this time Friday, the price was trading at $3246

在盘前市场 , 主要指数的快照是在本周的收益浪潮之前上升 :

- Dow Industrial Average futures are implying a gain of 160 points. On Friday, the Dow Industrial Average closed higher by 654.27 points or 1.64% at 40,589.35

- S&P futures are implying a gain of 21.90 points . On Friday, the S&P index closed higher by 59.86 points or 1.11% at 5459.09.

- Nasdaq futures are implying a gain of 110.59 points . On Friday, the index closed higher by 176.16 points or 1.03% at 17357.88

- On Friday, the Russell 2000 index rose by 37.08 points or 1.67% at 2260.06.

欧洲股票指数走高.

- German DAX, + 0.23%

- France CAC, -0.44%

- UK FTSE 100, +0.86%

- Spain’s Ibex, +0.19%

- Italy’s FTSE MIB, +0.07% (delayed 10 minutes).

亚太市场的股票收高 :.

- Japan’s Nikkei 225, +2.13%

- China’s Shanghai Composite Index, +0.03%

- Hong Kong’s Hang Seng index, +1.28%

- Australia S&P/ASX index, +0.86%.

从美国债市来看 , 收益率正在走低 :

- 2-year yield 4.3709%, -1.8 basis points. At this time Friday, the yield was at 4.434%

- 5-year yield 4.048%, -3.3 basis points. At this time Friday, the yield was at 4.132%

- 10-year yield 4.160%, -3.8 basis points. At this time Friday, the yield was at 4.240%

- 30-year yield 4.414%, -4.3 basis points. At this time Friday, the yield was at 4.41%.

从国债收益率曲线来看 , 它变得更加负面.在上周大部分时间都在积极区域交易之后 , 两年 – 30 年的价差又回到了负数区域 ,

- The 2-10 year spread is at -21.2 basis points. At this time Friday, the spread was at -19.6 basis points.

- The 2-30 year spread is -2.1 basis points. At this time yesterday, the spread was +4.5 basis points.

在欧洲债券市场 , 基准 10 年期收益率较低 :