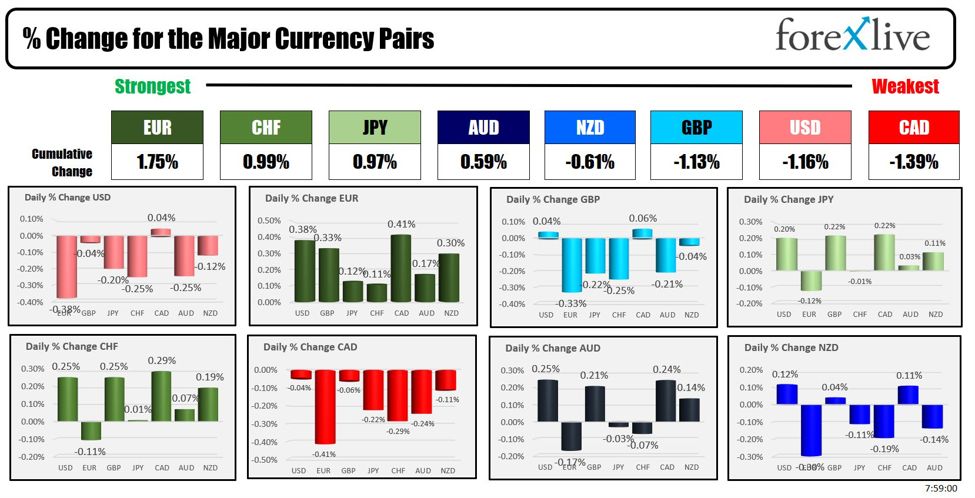

The EUR is the strongest and the CAD is the weakest as the NA session begins.

The USD is weaker ahead of the US jobs report.Yields continue its fall as it does the Fed’s work for them now as data keeps coming in weaker and weaker. Stocks continue its slide as the biggest consumer retailer (Amazon) missed and did not foresee good news ahead.

For the US jobs report which will be released at 8:30 AM ET, what’s expected:

- Consensus estimate +175K (LBBW at the low at +70K, Bank of American at the high at +225K)

- June +206K vs +190K expected

- Private +148K estimate vs +136K prior

- Unemployment rate consensus estimate: 4.1% vs 4.1% prior

- Participation rate: 62.6% prior

- Prior underemployment U6 7.4%

- Avg hourly earnings y/y exp +3.7% y/y vs +3.9% prior

- Avg hourly earnings m/m exp +0.3% vs +0.3% prior

- Avg weekly hours exp 34.3 vs 34.3 prior

July jobs so far:

- ADP report +122K vs +150K expected and +155K prior.. Weak

- ISM services employment not yet released

- ISM manufacturing employment 43.4 vs 49.3 prior (lowest since 2020). Weak.

- Challenger job cuts 48.8K vs 64.7K prior. Intel kickstart that for next month.

- Philly employment +15.2 vs -2.5 prior (highest in nearly 2 years). Strong

- Empire employment -7.9 vs -8.7 prior. Negative. Weak

- Initial jobless claims survey week 245K vs 228.5K expected. Weak.

US stocks are down sharply ahead of the jobs report with the major indices tumbling after Amazon missed (think biggest retailer folks). Intel missed (they are just out of the picture). Apple was solid but not enough to stop the slide.

The shift is official: bad news is bad news as focus is not just on inflation anymore and the economy is showing signs of cracks. The economic data yesterday was a clean sweep for "bad", with initial and continuing claims weak, construction spending weak, and the PMI also weak. The quarterly employment cost index data was also 1/2 of expectations (0.9% for the quarter vs 1.8% estimate). In the past that would have been cheered but that is not good news now as focus shifts to the economy.

The Fed passed this week, but two days later they may already be hoping they took out some insurance. Nevertheless, the US yields are doing the work with the 10 year now 8 basis points below 4% (lowest level since February) at 3.92%. The 2 year is at 4.11% at its lowest level since May 2023 (took out the low from January at 4.12%). BTW the 2 and the 10-year yields are down -27 bps on the week. From the end of April high, the 2 year is down -94 bps, and the 10 year is down -80 bps.

The BOE did cut rates yesterday despite Taylor Swift service inflation bump. However, the cut was by the smallest of margins with a member vote of 5-4 in favor of a cut.

Buckle up.

A snapshot of the other markets as the North American session begins shows:

- Crude oil is trading down $0.11 or -0.16% at $76.19 at this time yesterday, the price was at $78.42. For the week, the price is down -$1.43

- Gold is trading up $15 or 0.62% at $2460. At this time yesterday, the price was trading at $2442.07. For the week, the price of gold is up $73.

- Silver is trading up $0.42 or 1.48% at $28.92. At this time yesterday, the price is trading at $28.94. For the week, the price is up $1.00

- Bitcoin trading at $64,609. At this time yesterday, the price was trading at $64,689. Earlier this week the price extended above $70,000. For the week, the price is down -$3557

- Ethereum is trading at $3149.90. At this time yesterday, the price was trading at $3190

In the premarket, the snapshot of the major indices are sharply lower. The S&P and Nasdaq indices are on pace for the 3rd week in a row lower. For the Dow, it is on pace to snap its 4 week gain streak.

- Dow Industrial Average futures are implying a loss of -381 points. Yesterday, the Dow Industrial Average fell -494.82 points or -1.21% at 40,347.98.

- S&P futures are implying a loss of -67 points. Yesterday the S&P index closed lower by -75.60 points or -1.37% at 5446.69.

- Nasdaq futures are implying a loss of -357 points. Yesterday the index closed lower by -405.25 points or -2.30% at 17194.15

- Yesterday, the Russell 2000 index fell -68.32 points or -3.03% at 2186.16

European stock indices are trading lower as they react to lower global growth.

- German DAX, -1.57%. For the week the index is down -3.47% (on pace for its weakest week since March 2023)

- France CAC, -0.78%. For the weekly index is down -2.7%.

- UK FTSE 100, -0.37%. For the week index is down -0.35%.

- Spain’s Ibex, -0.74%. For the week the index is down -3.43%.

- Italy’s FTSE MIB, -1.67% (delayed 10 minutes).. For the week the index is down -4.37%

Shares in the Asian Pacific markets closed mostly lower:

- Japan’s Nikkei 225, -0.81%. For the week, the index fell -4.67%.

- China’s Shanghai Composite Index, -0.92%. For the week, the index rose 0.50%.

- Hong Kong’s Hang Seng index, -2.08%. For the week the index fell -0.45%

- Australia S&P/ASX index, -2.11%. For the week the index rose 0.30

Looking at the US debt market, yields are continuing to move lower as the markets react to lower growth.

- 2-year yield 4.134%, -3.0 basements. At this time yesterday, the yield was at 4.290%

- 5-year yield 3.807%, -3.9 basis points. At this time yesterday, the yield was at 4.946%

- 10-year yield 3.941%, -3.7 basis points. At this time Friday, the yield was at 4.058%

- 30-year yield 4.241%, -2.9 basis points. At this time Friday, the yield was at 4.327%

Looking at the treasury yield curve, the spreads are little changed from yesterday

- The 2-10 year spread is at – -19.0 basis points. At this time yesterday, the spread was at -23.2 basis points.

- The 2-30 year spread is at +10.4 basis points. At this time yesterday, the spread was +3.9 basis points. That is the most positive sense August 2022

In the European debt market, the benchmark 10-year yields are lower: