FundamentalOverview

The USD continues to bebacked by good economic data as we have also seen recently from the US PMIs last Friday and the US Consumer Confidence report this week. Although suchdata keeps the interest rates expectations stable around two cuts by the end ofthe year, it should also support the risk sentiment amid a pickup in growth.This could be a headwind for the greenback.

This week the US Dollar hasbeen in the driving seat, although it looks like the price action is beinginfluenced more by month-end, quarter-end and half year-end flows rather thansomething fundamental. We had also a key breakout in USDJPY yesterday and flowsthere might have spilled over to other major pairs.

We got also the Canadian CPI figures this week which surprisedto the upside and trimmed rate cuts expectations for July with the market nowpricing a 65% chance of no change. That was not enough to break out of thestrong support zone around the 1.36 handle as it didn’t change much the bigger picture,but it might keep the Loonie supported going forward once the quarter-end flowsfade out.

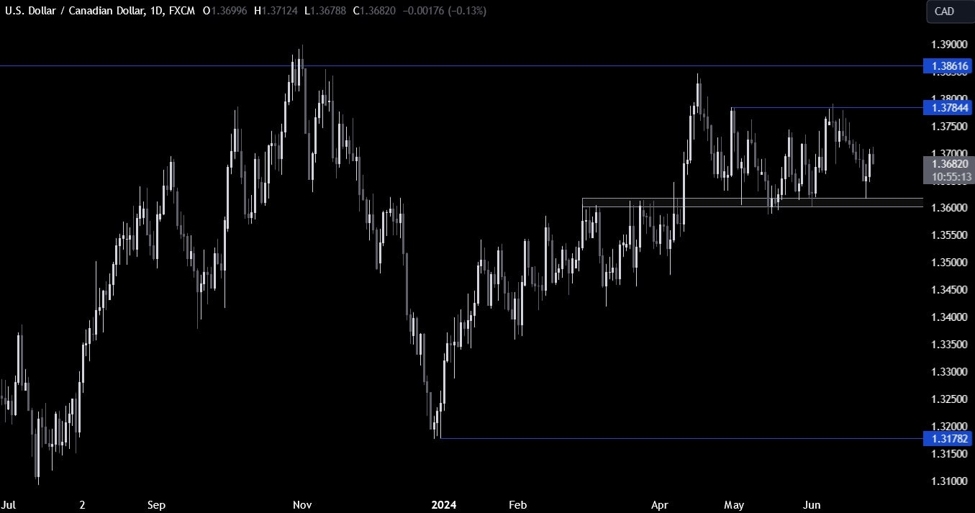

USDCADTechnical Analysis – Daily Timeframe

On the daily chart, we cansee that USDCAD bounced on the key support zone around the 1.36 handle. That’s where thebuyers continue to step in with a defined risk below the support to positionfor a rally back into the 1.3785 resistance. The sellers will want to see theprice breaking lower to pile in more aggressively and target a drop into the1.34 handle next.

USDCAD TechnicalAnalysis – 4 hour Timeframe

On the 4 hour chart, we cansee that the price yesterday broke above the 1.3680 resistance and pulled backto retest it today. We can also see that we have the 38.2% Fibonacciretracement level for confluencethere.

This is where the buyerswill likely step in with a defined risk below the level to target an extensionof the rally towards the 1.3785 resistance. The sellers, on the other hand,will want to see the price falling back below the level to regain some controland position for a break below the 1.36 support with a better risk to rewardsetup.

USDCAD TechnicalAnalysis – 1 hour Timeframe

On the 1 hour chart, we cansee that we had also a downward trendline adding some extra confluence to the1.3680 resistance. This breakout might give the buyers more conviction for arally back into the 1.3785 resistance next. The red lines define the average daily range for today.

UpcomingCatalysts

Today we get the latest US Jobless Claims figures, while tomorrow we concludethe week with the Canadian GDP and the US PCE report.