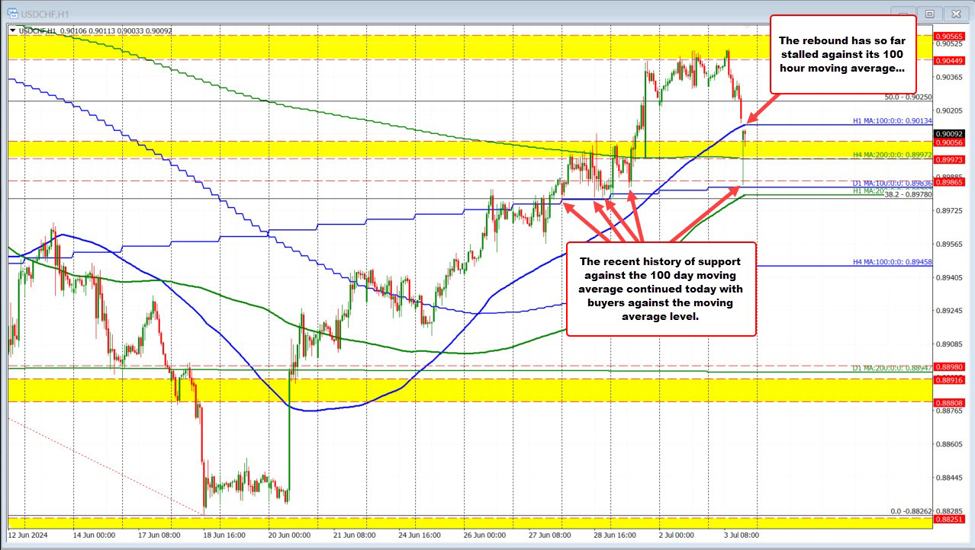

The USDCHF moved lower after the weaker than expected US data today. However, after breaking below its 100-hour moving average at 0.90134, its 200 bar moving average on the 4-hour chart at 0.89972, support buyers came in against the key 100-day moving average at 0.89836.

Recall from Friday last week and Monday’s trade this week, the low prices on those two trading days did find support buyers against that 100-day moving average. So there has been a history of support from traders against that key daily moving average level.

Going forward it would take a move below that 100 day moving average and staying below to give the sellers more control. Absent that and the move is a corrective move in what has been a bull market over the last few weeks for the USDCHF.

On the top side getting above the 100-hour moving average at 0.90134 is needed to confirm that the dip buyers are taking back control after the selloff today.